- 1. Forex line trading offers various strategies.

- 2. Range Line Trading for sideways markets.

- 3. Breakout Line Trading for crazy times. Prepare yourselves, everyone!

- 4. Trend line reversals for market changes.

- 5. Confluence Trading for precision.

- 6. Each method has its own advantages and disadvantages.

- 7. Change strategies based on market conditions. Great advice, correct?

- 8. Boost your trading success by making smart choices.

Traders often manage the forex market like pros, and one go-to strategy is Range Line Trading, which helps them utilize the predictable patterns of range-bound price movements.

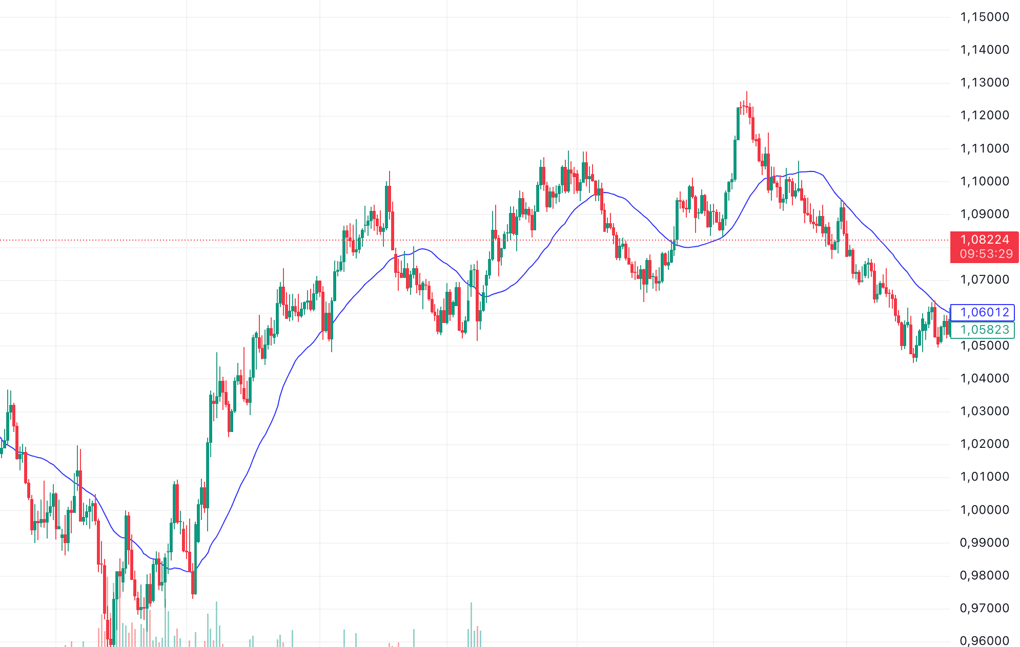

Picture the EUR/CHF pair stuck between 0.95250 and 0.96500; traders mark these key support and resistance lines, buying at 0.95250 and selling near 0.96500, making profits from these ups and downs.

In 2022, the EUR/CHF pair exhibited this behavior for multiple months, with historical charts from MetaTrader 4 and TradingView highlighting these patterns and offering plenty of opportunities for profitable trades. This strategy is simple, allowing traders to work within a set range, trading forex using line chart.

However, false breakouts can complicate things, similar to tricky waves that mislead boats. Tools like the Relative Strength Index (RSI) are useful in these situations.

- ->When RSI drops below 30, it signals an oversold condition, indicating that traders should buy near support.

Each trade has costs, similar to a boat's maintenance fees, and traders need to account for these to ensure they achieve good gains.

Use RSI to confirm entry points and always factor in trading costs to stay profitable in Range Line Trading. No one likes random fees cutting into their gains.

Catching pips can be difficult, as catching fish can be.

Forex trend line trading strategy explained

For those who love big waves, Breakout Line Trading gives them the hit they want. Imagine the EUR/USD pair hovering below a resistance line of 1.1500, building anticipation among traders.

Once the pair surges past this level with a 20% volume spike over the 30-day average, they jump in, riding the wave like storm chasers.

In the past, when the EUR/USD pair broke past 0.97000, it went up to 1.05000, giving an almost 200-pip move.

This jump means big gains, like catching huge waves during a storm.

Big waves come with big risks. In 2020, the GBP/USD pair had several fake breakouts, where the initial spikes didn't last.

Traders keep a close eye on volume indicators, SMAs or the MACD to confirm real breakouts and avoid getting caught in the turbulence.

- ->A 5% rise in trading volume can help tell the difference between real breakouts and short-lived ones.

Wider trading spreads during crazy times are like sudden gusts hitting a ship's sails, making cost-aware strategies a necessity.

Always confirm breakouts with volume indicators to reduce risks in Breakout Line Trading. (Relying on luck isn't a solid strategy).

Forex trend line trading strategy: timing market shifts

Skilled traders can sense market shifts just like sailors read changing currents. They're adept at identifying Trend Line Reversals.

Watching the GBP/USD pair in a downward trend is like sailing through headwinds. When the price breaks the trend line, they know a change is imminent.

Confirmation comes from large candlesticks or increased volume, indicating the tides are turning.

At the end of 2021, the AUD/USD provided a perfect example. It broke a major trend line, and the 14-day moving average crossed above the 50-day moving average, confirming the reversal.

Traders who capitalized on this opportunity saw gains from 0.7200 to 0.7500—a 300-pip rise.

This strategy demands precise timing and careful confirmation, much like sailors adjusting their sails to changing winds. Misidentifying a reversal can lead to early entries and losses. Using additional indicators, such as moving averages, provides more assurance.

Use multiple confirmations and tighter stop-loss orders to trade Trend Line Reversals effectively. Blindly jumping in without a plan is never a good idea.

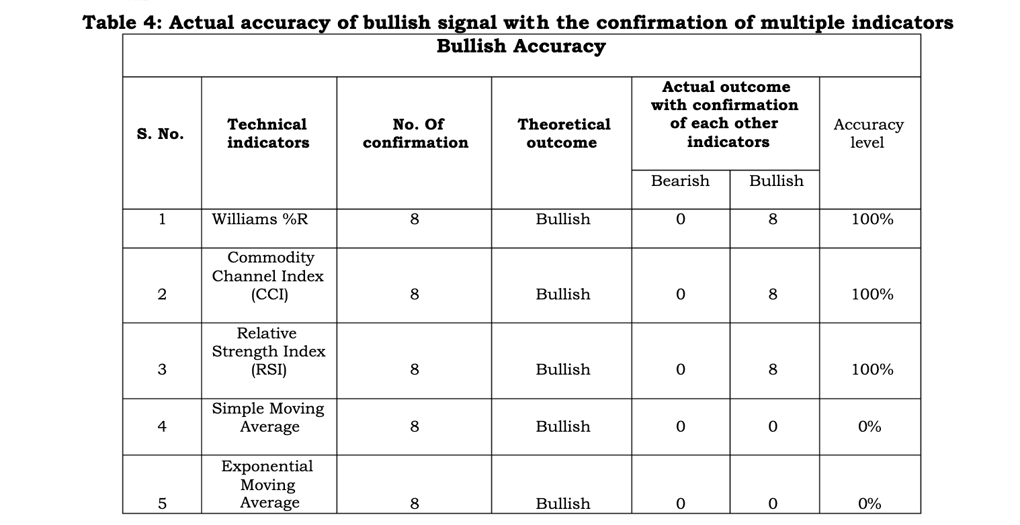

Studies from the Chandra Bhooshan Singh from the Kalinga University Raipur show that multiple confirmations can boost win rates by a significant rate. Tighter stop-loss orders are crucial to minimizing minor losses while realizing big gains, keeping traders profitable even if the initial attempts don't work out.

- ->Profit, even if it's modest, is a welcome outcome.

Trading forex with line charts: the power of confluence

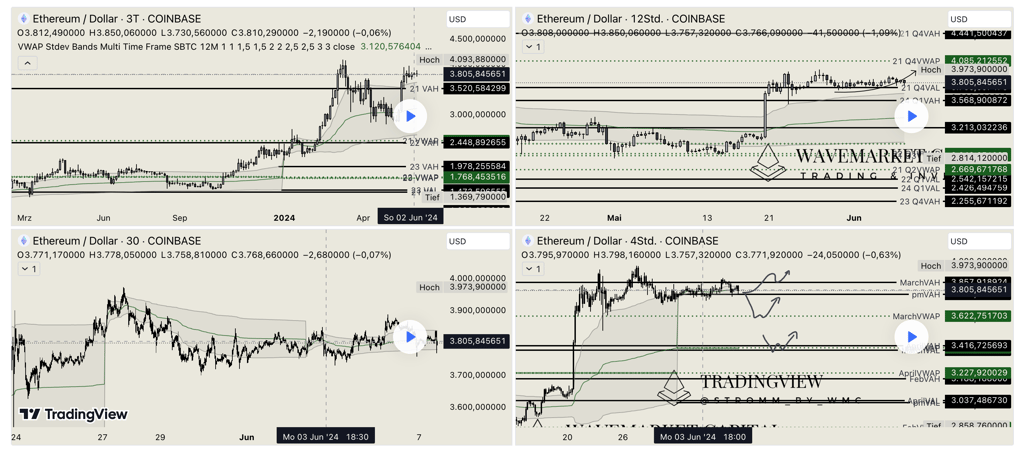

Beating the forex market with precision requires combining different techniques. Confluence Line Trading achieves this by merging forex line chart analysis with indicators such as moving averages, Fibonacci retracements, and RSI.

For instance, imagine the EUR/USD breaking a trend line, with RSI below 30 and hitting the 61.8% Fibonacci retracement. This powerful combination creates a strong trade setup, similar to currents merging into a powerful stream.

In January 2024, the USD/JPY pair broke a resistance trend line while RSI was at 35 and hit the 50% Fibonacci retracement. This combination generated a strong buy signal, leading to a 150-pip profit as the pair moved from 110.00 to 111.50.

Historical data demonstrates that using multiple confirmations can increase success rates by up to 20% compared to relying on a single method.

While this method can be challenging for beginners, balancing multiple indicators requires a good understanding and can lead to analysis paralysis if not done correctly. A well-coordinated approach can be very successful if executed precisely.

Moreover, execution fees for these strategies can add up, so traders need to be aware of their brokers' fee structures to manage costs effectively.

Using multiple confirmations in Confluence Line Trading makes it more accurate and increases success rates. Guessing just doesn't work.

Minimizing fees is important to retain profits.

Common mistakes to avoid in forex line trading

Forex line trading can be risky, as over-trading to chase every signal can lead to exhaustion of your resources.

Ignoring stop-losses can result in significant losses, similar to not wearing life jackets in a storm.

Emotional trading can disrupt your plans, leading to impulsive decisions. Discipline is important, and according to the CFA Institute, traders who avoid over-trading and use stop-losses experience 25% fewer losses than those who don’t.

A trading journal serves as a valuable tool, providing insights and helping traders stay disciplined. Even experienced traders struggle with emotions, but recording trades and feelings in journals helps them maintain a balanced perspective and make informed decisions.

Many traders struggle with discipline, but it is a crucial aspect of successful trading.

Keep a trading journal and stick to stop-loss rules to avoid common mistakes in forex trading. Losing all your money would definitely ruin your day.

Conclusion: mastering forex line trading

Experiencing the forex market's ups and downs shows different trading styles, each with its unique approach. Mastering Range Line Trading utilizes sideways movements, while Breakout Line Trading check for big price jumps.

- ->Trend Line Reversals identify key changes

- ->Confluence Line Trading combines strategies for better accuracy

Each method has its own pros and cons, helping traders achieve better results in forex markets. Consistent learning and practice are essential for success. Just like sailors adjust to the sea, traders need to adapt to the forex market's changes.

Staying flexible and informed enables traders to trade with confidence. By mastering these methods, traders can handle the forex markets with skill, and the market's unpredictability and excitement can offer a crazy experience.

Hope your trading experience is smooth, smart, and successful.

Keep learning and adapting to get good at forex line trading. I mean, who needs sleep when you can learn forex all night, correct?